The pressure to reduce the cost of new developments has never been greater for North Sea operators. The combination of low oil prices, decreased North Sea development opportunities and increased competition from the U.S. shale industry means the industry is being forced to adapt to new ideas.

One development concept that is starting to gain traction is the use of low-cost wellhead platforms for the development of small satellite fields. These are typically newly discovered fields close to an established host platform, which can provide control and power and also carry out fluid processing. Although wellhead platforms have long been a favorite in the shallow waters of the southern North Sea, up until now the preferred option for the development of satellite fields in deeper water has been to use a subsea manifold with a tieback to the host facility. Subsea manifolds are tried, tested and trusted, but WorleyParsons has carried out several studies showing that subsea manifolds don’t necessarily provide the best value solution for a multiple well development. The difficulties and additional costs associated with maintenance and future well intervention operations can all contribute to increased costs over the lifetime of a project.

WorleyParsons has accumulated a reference list of more than 500 installations that are currently operating throughout the world, and its team has combined its experience with ideas borrowed from the shale industry—where standardization and modularization of equipment is the key to low-cost field development. The company has come up with a new concept in wellhead platforms suitable for installation in deeper water and able to withstand North Sea conditions.

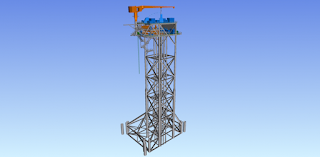

The new design uses piled foundations, can be deployed in water depths of up to 120 m (394 ft) and provides space for a maximum of 12 well slots. No accommodation has been provided for personnel, who will gain access for four monthly maintenance visits by vessels equipped with a “walk-to-work” gangway. The platform design includes a 5-tonne crane and sufficient deck space to allow full access for future well intervention. WorleyParsons also has designed the new platform for construction in its covered yard near Stavanger, Norway, with one flat side to permit installation by either barge launch or jackup platform to widen the choice of installation contractor.

The platform is designed with a “design once, build many” approach to capture economies of scale and efficiencies more closely associated with a production line than a North Sea construction yard. The design borrows from the philosophies that WorleyParsons has previously followed in the Persian Gulf and Gulf of Thailand and uses a minimum number of different profiles to reduce procurement and stockholding costs.

Topsides and jacket weights are comparable to more traditional North Sea designs at about 650 tonnes and 3,500 tonnes, respectively, for a 100-m (328-ft) water depth platform, with almost all of the topsides and much of the jacket being identical for any platform regardless of water depth. However, there is scope for significant savings in project schedule by both reducing setup times and by allowing construction to start in parallel with detailed design. The design is so standardized that water depth, seabed conditions and well slot arrangement are the only pieces of information required to completely define an individual platform, further reducing project schedule and minimizing construction risk.

WorleyParsons sees an immediate market for at least 20 lowcost modularized platforms in the Norwegian sector of the North Sea alone and is talking to several operators who have been carrying out studies to assess their viability. They also see applications in U.K. waters, where the upcoming 30th licensing round will be targeting small pool discoveries that will require especially low-cost development schemes.