Oil drilling has now been practiced for over a century. The sector has developed by leaps and bounds as a result of several technological breakthroughs. This expansion has resulted in new advances in oil production that are altering the face of our civilization.

As early as 1880, the globe witnessed one of the earliest developments known as the rotary drill, which dramatically enhanced the oil drilling process. This rotary drill, however, was just the beginning of a lengthy line of subsequent developments that would eventually replace it in the twentieth century. In this post, we'll look at some of the most significant breakthroughs in oil production efficiency.

1. Offshore Drilling and ROVs

Oil drillers quickly discovered that wells located near seashores generated the most oil. This is why the industry needed to develop technologies for extracting oil from the seafloor. Drilling companies built oil rigs on several wharves in the 1980s, but the first oil well on land was discovered somewhere about 1947.

Remotely operated vehicles were among the early technologies that aided the establishment of these offshore drilling enterprises (ROVs). The US military was already using this technique to recover equipment that had been lost at sea. The oil sector was exploiting ROVs for their own purposes by the 1970s.

2. Hydraulic Fracturing

Fracking, or hydraulic fracturing, is another new technology that Shale Gas relies on. This approach, which was created in 1940, has grown in popularity. Fracking is based on tight reservoirs, which often contain oil-bearing rocks with small holes, implying that the flow of oil from these is limited.

Drillers utilize fracturing to stimulate these wells by putting chemicals mixed with water into the well to produce pressure. This pressure, in turn, causes fractures in the rocks that can be hundreds of feet long. After these fissures are created, oil is allowed to flow freely out of the rock. According to numerous studies, fracking has contributed to an additional seven billion dollars oil barrels from wells in the United States.

3. Seismic Imaging

Initially, looking for oil wells was based solely on where oil had bubbled to the surface. Because most oil wells are buried far beneath the earth's surface, they cannot be discovered. Digging deep wells to set up rigs only to find barren patches was also highly costly.

Geologists were brought in to devise methods for locating oil wells that were hidden. They devised numerous approaches, the most important of which was 3-D seismic imaging. This system transmits sound waves into the ground and detects signals as the waves bounce off of obstacles.

This technology not only assisted in locating the most productive locations for establishing oil production units, but it also reduced the number of holes that were drilled without success.

4. Measurement-While-Drilling Systems

One major disadvantage of seismic technologies was that they did not provide drilling operators with precise information about the amount of oil they were working with. These concerns were resolved in the 1980s thanks to a technology known as measurement-while-drilling (MWD).

With this system and its reliance on'mud pulse telemetry,' operators were able to collect and analyse real-time data, allowing them to establish the state of the oil well. This technology, in turn, enabled operators to drive oil wells in different ways based on the data they had gathered.

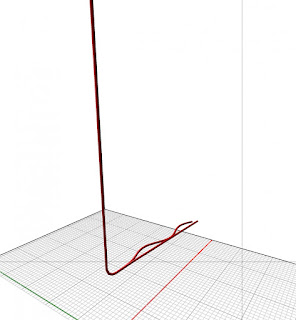

5. Horizontal Drilling

We emphasized the potential of operators to steer their oil drilling operation in multiple directions while discussing MWD technologies. This capacity to drill in directions other than straight has become one of the most significant technological achievements in the history of the oil drilling process.

Oil reservoirs tend to be spread out horizontally from time to time, making vertical wells an ineffective method of extraction. This is why these technologies enable operators to dig vertically initially and then pivot to a horizontal well at the 'kick-off point.'

This technology has not only enabled the extraction of oil from horizontal wells, but it has also assisted operators in conducting their operations in a more environmentally friendly manner. The first horizontal wells were dug in 1929, but the process was prohibitively expensive at the time. However, with the introduction of hydraulic fracturing, horizontal drilling became a more inexpensive and realistic choice. By the late 1980s, nearly all oil drilling companies across the world were adopting horizontal drilling.